Retirement: My Plan

Log in today

Ver en español | 查看中文 | 한국어로 보기 | Посмотреть на русском | Xem bằng tiếng việt | አማርኛ | عربى | Soomaali | Переглянути укр | មើលជាភាសាខ្មែរ

Log in to your retirement account today!

With Retirement: My Plan, you can:

- See your balance.

- Name a beneficiary who will get your funds if you pass away.

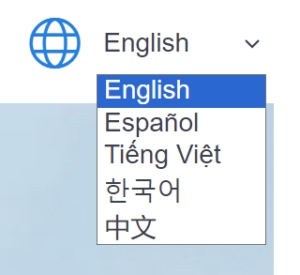

Retirement: My Plan is now available in English, Spanish, Vietnamese, Korean and Chinese.

To access your account in your preferred language, press or click on the arrow in the top right corner of the screen on the Milliman website to change your language preference.

How to Create Your Account and Log in

You get to Retirement: My Plan by logging in on the Milliman website. If you have not logged in since June 2020, you need to create a new account.

Caregivers

Logging in today helps you receive important information quicker.

Retirement: My Plan gets your updated contact information from your employer. Make sure to keep your contact information up to date with your employer so you get retirement information as quickly as possible.

Milliman is the administrator for the Secure Retirement Plan (SRP). Milliman will send you account statements and additional information by email or mail.

Questions?

For help, contact a Secure Retirement representative at 1-800-726-8303 (5 a.m. to 5 p.m. Pacific time, Monday-Friday). Help is available in your language.