Common Questions About

Your Secure Retirement

There are many common questions caregivers have about the Secure Retirement Plan. Click each question to learn more.

How do I participate in the plan?

Q. How do I participate in the secure retirement plan?

A. Check www.seiu775.org/findyourcontract/ to see if your employer is included.

If your first day as a caregiver is on or after July 1, 2019, you will become a participant in the plan as of the first day of the calendar month on or following the six month anniversary of your start date. In order to qualify, you must be “active” in the Plan on the six month anniversary of your start date.

To be considered “active” you must have at least 1 qualifying hour worked on or after your six month anniversary and prior to a gap of 12 months since your last qualifying hour worked. Once we receive the information that qualifies you as a participant (typically in the month following the month in which the work occurs), you will receive a welcome letter and a copy of the Summary Plan Document. You will also gain online access to your account and will be able to specify your beneficiary at that time.

Quick Guide to Participation Date:

| First Month Worked | Jan-20 | Feb-20 | Mar-20 | Apr-20 | May-20 | Jun-20 | Jul-20 | Aug-20 | Sep-20 | Oct-20 | Nov-20 | Dec-20 |

| Earliest Partici-pation Date1

(1st of every month) |

Jul-20 | Aug-20 | Sep-20 | Oct-20 | Nov-20 | Dec-20 | Jan-21 | Feb-21 | Mar-21 | Apr-21 | May-21 | Jun-21 |

1 You must report hour between the month of your participation date and before the first anniversary of your last qualifying hour.

Quick Guide to Service-Spanning Rule:

| Last Month Worked | Jan-20 | Feb-20 | Mar-20 | Apr-20 | May-20 | Jun-20 | Jul-20 | Aug-20 | Sep-20 | Oct-20 | Nov-20 | Dec-20 |

| Must Resume Service by 2 | Jan-21 | Feb-21 | Mar-21 | Apr-21 | May-21 | Jun-21 | Jul-21 | Aug-21 | Sep-21 | Oct-21 | Nov-21 | Dec-21 |

2 If you haven’t yet become a participant, you will be treated as active for a period of up to 12 months following a quit, discharge or retirement provided you return to service.

Here are some common examples of how you might become a participant:

Continuous caregiving – you became a caregiver on July 5 and continue to provide care every month.

Once your January hours are reported (typically in February), you would become a participant in the plan as of Jan. 1.

Temporary break in caregiving – you became a caregiver on July 5 and provided care from July through December. In January, your client entered the hospital, and you resumed caregiving in February.

Once your February hours are reported (typically in March) due to the service spanning rule, you would become a vested participant in the plan as of Jan. 1.

Longer break in caregiving – you became a caregiver on July 5 and provided care from July through September 30. You then left the profession but returned to caregiving in September of the following year.

Once your September hours are reported (typically in October), you would become a vested participant in the plan as of Jan. 1 due to the service spanning rule.

Contributions are made to your account once you become a participant.

If you leave caregiving before completing a 6-month period of participation service and do not return on or before the first anniversary of your departure, you do not become a participant and no contributions will be made to an Account on your behalf.

Plan terms are detailed in the plan documents. The Summary Plan Description describes key features of the plan. In the event of a conflict between these highlights or the summary plan description, and the plan documents, the plan documents control.

Q. What obligation do I have as a participant in the Secure Retirement Plan?

A. You must keep our administrative office advised of any change of address so that we are able to contact you and you continue receiving your annual statement and summary annual report (SAR). You should also designate a beneficiary to receive your funds in the event you pass away before your entire account is paid out. You may update your address and beneficiary information by visiting our secure portal at www.myseiu.be/myplan-srp or calling 1-866-770-1917 (M-F 5 a.m. to 6 p.m.).

How Do I Vest In The Plan?

Vesting means you have a non-forfeitable right to the amounts credited to your account. In other words, once you are vested, these funds “belong” to you.

Q. How do I become vested?

- If you became a participant before July 1, 2019, you become vested one of two ways:

- You completed three years of vesting service. You earn a year of vesting service in each plan year prior to February 28, 2020 in which you worked at least 300 hours.

- You worked at least 1 additional qualifying hour on or after July 1, 2019.

Note: If you incur a permanent break in service before you work a qualifying hour on or after July 1, 2019, you will be immediately vested in future contributions, but you will not be vested in contributions made before the permanent break. If you don’t meet the hours requirement for five plan years in a row, you will experience a “permanent break in service”. At that point, your accumulated balance will be forfeited to the plan.) If you need help finding a new client, you may want to check out Carina.

2. If you became a participant on after July 1, 2019, you are immediately vested in contributions made to your account.

Q. What type of hours count for the 300-hours vesting requirement?

A. In addition to hours providing service to clients, training hours and paid time off (PTO) hours count toward satisfying the 300 hours requirement for a year of vesting service. This is true even though contributions are not made to the retirement plan for training hours and paid time off.

This means you may have more hours for vesting than for contributions purposes. Your Collective Bargaining Agreement determines the hours for which your employer must make a contribution to the plan.

Q. What happens if I don’t have enough hours to vest?

A. If you didn’t meet the hours requirement before July 1, 2019, and you don’t return to plan service for 5 plan years in a row, you will experience a “permanent break in service.” At that point, your accumulated balance will be forfeited to the plan. However, if you return to plan service after July 1, 2019 before you experience a permanent break in service, you will be immediately vested in all past and future contributions to your account.

Q. What obligation do I have as a vested participant in the Secure Retirement Plan?

A.You need to keep our administrative office advised of any change of address so that we are able to contact you and you continue receiving your annual statement and summary annual report. You should also designate a beneficiary to receive your benefit in the event you pass away before your entire benefit is paid out. You may update your address and beneficiary information by visiting our secure portal at myseiu.be/myplan-srp or calling 1-800-726-8303 (M-F 5 a.m. to 6 p.m.).

What If I Want To Retire?

Q. How can I start receiving my retirement funds?

A. Generally, you must reach the plan’s normal retirement age (65 years or older) to access your retirement benefit.

Q. If I am at or near retirement age (65), what does the retirement plan mean for me?

A. This will depend on a variety of factors: how many hours you work, future collective bargaining agreement contribution levels, when you actually choose to retire (assuming you meet plan requirements), investment performance over time, and the terms of the Plan.

Q. How do I receive retirement payments from the retirement plan?

A. You must be age 65 or older, and 2. You must be fully vested in the plan. Go to myseiu.be/myplan-srp to request a retirement application.

Q. How is the benefit paid to me?

A. If your account is more than $2,400, it will be paid in monthly installments. If your account is $2,400 or less, it will be paid in a single lump sum.

Q. If I am nearing retirement age, what can I do to improve my levels of retirement income?

A. You might be able to increase the number of hours/years you work to increase the amount of money contributed.

You may also want to check www.ssa.gov to understand the best strategy for your situation to maximize your Social Security benefit.

Q. Am I required to take required minimum distributions at age 72 if I am still working?

A. No. You can delay beginning payments until as late as April 1 of the calendar year after the year in which you stop working.

Under federal tax law, you may be subject to a 50% excise tax if you don’t begin payment of your benefit by this date.

What Happens If I Am No Longer A Caregiver?

Q. What if I leave home care work before I reach normal retirement age?

A. If you are vested, your funds are paid to you even if you leave before retirement. If your account balance is $2,400 or less, your funds will be paid after you haven’t worked for 24 consecutive calendar months. If your account balance is more than $2,400, your balance will be paid when you reach normal retirement age.

Q. What happens if I pass away before receiving my entire retirement benefit?

A. If you are vested, your funds will be paid out to your beneficiaries either as a lump sum or under the payment plan previously established for you. You should also designate a beneficiary to receive your benefit in the event you pass away before your entire benefit is paid out. You may update your address and beneficiary information by visiting our secure portal myseiu.be/myplan-srp or calling 1-800-726-8303 (M-F 5 a.m. to 6 p.m.).

Q. I never named any beneficiaries, who will receive my funds if I pass away?

A. If you are vested but have not named specific beneficiaries, the plan will default to paying out your balance as follows:

- First to your surviving spouse.

- If there is no spouse, then to your living children (natural, adopted and step)(in equal shares).

- If there are no children, then to your living parents (in equal shares).

- If there are no living parents, then to your living siblings (in equal shares).

You may designate specific beneficiaries by going to myseiu.be/myplan-srp or calling 1-800-726-8303 (M-F 5 a.m. to 6 p.m.).

Q. What obligation do I have as a vested participant in the Secure Retirement Plan?

A.You need to keep our administrative office advised of any change of address so that we are able to contact you and you continue receiving your annual statement and summary annual report. You should also designate a beneficiary to receive your benefit in the event you pass away before your entire benefit is paid out. You may update your address and beneficiary information by visiting our secure portal at myseiu.be/myplan-srp or calling 1-800-726-8303 (M-F 5 a.m. to 6 p.m.).

What Is Included In My Account Balance?

Q. How often does my account balance change?

A. Each day that the New York Stock Exchange is open, the plan updates the value of your account based on posted contributions and the value of the investments made on your behalf.

On the first business day of each month, your pro-rata share of any expenses are deducted from your account balance.

Q. What do you mean by pro-rata?

A. Pro-rata means that you will receive a proportionate share of overall expenses based on the size of your account relative to the entire plan. For example, if your account balance equaled one percent of the total balance of the plan, you would be assessed one percent of the expenses.

Expense

Q. What types of things are included in the expenses?

A. There are costs to operate or administer a retirement plan. They include things like recordkeeping (a system that records each participant transaction and account value) and participant mailings such as your annual statement.

Q. Who pays for expenses?

A. Administrative expenses are shared by all participants in the Plan.

Investments

Q. Who decides how the contributions the plan receives are invested?

A. The investments for the plan are directed by the plan Trustees. The Trustees have retained RBC (Royal Bank of Canada Brokerage) as its investment advisor for the Secure Retirement Trust.

- RBC provides investment recommendations to the Trustees.

- The Trustees retain ultimate decision-making authority for the investments and may accept or reject the recommendations.

- Both the Trustees and RBC are considered fiduciaries under a federal law known as “ERISA”

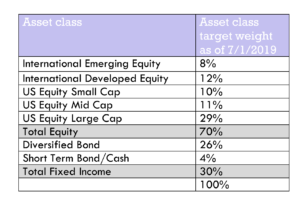

Q. What specific investments did the Trustees and RBC select?

A. As of July 1, 2019, assets were invested using the following guidelines:

As of July 1, 2020, assets were invested using the following guidelines based on your provided birthdate:

| Date of Birth | Portfolio | |

| 1957 or earlier | SRT 2020 | |

| 1958 – 1962 | SRT 2025 | |

| 1963 – 1967 | SRT 2030 | |

| 1968 – 1972 | SRT 2035 | |

| 1973 – 1977 | SRT 2040 | |

| 1978 – 1982 | SRT 2045 | |

| 1983 – 1987 | SRT 2050 | |

| 1988 – 1992 | SRT 2055 | |

| 1993 or later | SRT 2060 |

Why Should I Elect a Beneficiary?

Electing your beneficiary(s) is an important part of having a retirement plan.

If you do not select a beneficiary or beneficiaries, the plan rules, not your will, determine who receives your retirement funds if you pass away before you receive your money. By naming a beneficiary, you ensure that those funds are distributed based on your choice.

If you do not elect a beneficiary, the plan dictates beneficiaries in this order: surviving spouse or registered domestic partner, children, parents, siblings, estate.

Social Security

Almost every American worker can get Social Security benefits in their retirement by making payroll tax contributions. If you qualify, you get monthly Social Security payments starting as early as age 62. Not everyone gets Social Security, like some Parent Providers, but you may still qualify for a spousal benefit if you are married.

Here are 3 simple tips to help you understand Social Security and plan for your retirement:

- See if you qualify. You can see if you are paying into Social Security by looking at your pay stub. If there is money entered under “Social Security Employee Tax” then you should have Social Security.* Learn more about the Social Security Retirement benefit.

- Use this easy-to-use Social Security calculator. Enter your birth date and your income to see how much you could get from Social Security and how old you will be when you can start getting your full monthly payment.

- If you are ready to retire, create a my Social Security account to apply.

*If you do not qualify for Social Security, consider opening an IRA through Washington’s Retirement Marketplace. It’s easy and affordable!

Individual Retirement Accounts (IRAs) through Washington’s Retirement Marketplace

Opening an Individual Retirement Account (IRA) is an easy way to save more money for your retirement – on top of what you get through your SEIU 775 Secure Retirement Plan (SRP). You can open an IRA yourself with as little as $5 through Washington’s Retirement Marketplace, a trusted retirement partner.

The money you add to your IRA will earn interest and add up over time.

Why open an IRA?

- It’s just $5! It’s easy and affordable to open an IRA.

- Your money grows over time. Even if you can only put a small amount of money in your IRA each month, over time it can add a lot of money to your retirement.

- Have many sources of retirement income. The SRP is only one source of income you have when you retire. Saving your own money through an IRA can help you retire more comfortably.

Learn more about opening an IRA through Washington’s Retirement Marketplace, a trusted resource.

Personal Savings and Saving for Emergencies

Opening and contributing to a personal savings account is another important part of retiring. Saving as little as $5 each month can make a big difference by the time you are ready to retire.

It can be hard to plan for emergencies and unexpected costs like veterinary bills or car problems, let alone retiring. But, if you take some steps to plan, you can avoid having those expenses become a heavy burden.

Here are 4 tips to help you get started on your personal savings and saving for emergencies:

- Create a budget. Start by comparing how much money you earn each month versus how much you spend in a typical month. Then you can decide what you can spend less on, and how much money to put into a savings account.

- Set up automatic savings with your bank. You can decide how much and how often to save. Even saving as little as $5 each month can add up over time.

- Limit credit card use. Credit cards can be helpful in emergencies, but it can be easy to overspend and you may end up paying more in interest. When you have a savings account set up for emergencies instead, it could help you save money overall.

- Compare monthly expenses. Check if you qualify for a lower car insurance rate or try switching to a less expensive phone plan. The money you save could be put directly into your savings account!

الضمان الاجتماعي

يستطيع كل عامل أمريكي تقريبًا الحصول على مزايا الضمان الاجتماعي عند تقاعده من خلال تقديم مساهمات ضريبية على الراتب. إذا كنت مؤهلاً، ستحصل على المدفوعات الشهرية للضمان الاجتماعي بدءًا من سن 62 عامًا. لا يحصل الجميع على الضمان الاجتماعي، مثل بعض مزودي الرعاية من الآباء، لكن قد تظل مؤهلاً للحصول على إعانة الزواج إذا كنت متزوجًا.

فيما يلي 3 نصائح بسيطة لمساعدتك على فهم الضمان الاجتماعي والتخطيط لتقاعدك:

- اعرف ما إذا كنت مؤهلاً. يُمكنك معرفة ما إذا كنت تدفع في الضمان الاجتماعي من خلال النظر في راتبك. إذا كان هناك أموال تم إدخالها ضمن “ضريبة موظفي الضمان الاجتماعي (Social Security Employee Tax)”، فهذا يعني أنه ينبغي أن يكون لديك ضمان اجتماعي.* تعرف على المزيد بخصوص مزايا تقاعد الضمان الاجتماعي.

- استخدم حاسبة الضمان الاجتماعي سهلة الاستخدام هذه. أدخل تاريخ ميلادك ودخلك لمعرفة المبلغ الذي بإمكانك الحصول عليه من الضمان الاجتماعي، وكم سيكون عُمرك عندما يُمكنك البدء في الحصول على مدفوعاتك الشهرية بالكامل.

- إذا كنت على استعداد للتقاعد، فقُم بإنشاء حساب الضمان الاجتماعي الخاص بي للتقديم.

*إذا لم تكُن مؤهلاً للحصول على الضمان الاجتماعي، ففكر في فتح حساب التقاعد الفردي (IRA) من خلال سوق التقاعد في واشنطن (Washington’s Retirement Marketplace). إنه سهل وبأسعار ميسورة!

حسابات التقاعد الفردية (IRAs) من خلال سوق التقاعد في واشنطن

يعد فتح حساب التقاعد الفردي (IRA) طريقة سهلة لتوفير المزيد من الأموال المخصصة لتقاعدك – بالإضافة إلى ما تحصل عليه من خلال خطة التقاعد الآمنة (Secure Retirement Plan) (SRP) من SEIU 775 الخاصة بك. يمكنك فتح حساب التقاعد الفردي (IRA) بنفسك بأقل من 5 دولارات من خلال سوق التقاعد في واشنطن (Washington’s Retirement Marketplace)، وهو شريك تقاعد موثوق به.

ستجني الأموال التي تضيفها إلى حساب التقاعد الفردي (IRA) الخاص بك فوائد وستزيد الأموال بمرور الوقت.

ما السبب وراء فتح حساب التقاعد الفردي (IRA)؟

- لن يتكلف سوى 5 دولارات فقط! فمن اليسير فتح حساب التقاعد الفردي (IRA) وبأسعار معقولة.

- ستزداد أموالك بمرور الوقت. حتى ولو لم يكن بإمكانك سوى وضع مبلغ صغير من المال في حساب التقاعد الفردي (IRA) كل شهر، فإنه وبمرور الوقت يمكن أن يضيف الكثير من المال إلى حساب التقاعد الخاص بك.

- لديك العديد من مصادر الدخل الخاصة بالتقاعد. تُعتبر خطة التقاعد الآمنة (SRP) هي المصدر الوحيد لدخلك عند التقاعد. يمكن أن يساعدك توفير أموالك من خلال حساب التقاعد الفردي (IRA) على التقاعد بكل سهولة.

المدخرات الشخصية والمدخرات للطوارئ

يعد فتح حساب التوفير الشخصي والمساهمة فيه جزءًا مهمًا آخر من خطة التقاعد. يمكن أن يؤدي توفير أقل من 5 دولارات شهريًا إلى حدوث فرق كبير عند حلول الوقت الذي تكون مستعدًا فيه للتقاعد.

قد يصعب عليك التخطيط لأوقات الطوارئ والتكاليف غير المتوقعة مثل الفواتير الطبية البيطرية أو إصلاح مشاكل السيارات، ناهيك عن التقاعد. ولكن إذا اتخذت بعض الخطوات لوضع خطةٍ، فيمكنك تجنب أن تتحول مثل هذه المصروفات إلى عبء ثقيلٍ.

فيما يلي 4 نصائح لمساعدتك على البدء في المدخرات الشخصية والادخار لأوقات الطوارئ:

- ضع ميزانية. عليك البدء بمقارنة مقدار المال الذي تربحه شهريًا مقابل المبلغ الذي تنفقه في أي شهر عادي. ليتسنى لك بعدها أن تقرّر ما يمكنك أن تقلل معدل الإنفاق عليه، ومقدار الأموال التي بمقدورك ادخارها في حساب التوفير.

- قم بإعداد خطة توفير تلقائية مع البنك الذي تتعامل معه. يمكنك أن تقرر مقدار المبلغ المُدخَر وعدد مرات الادخار. حتى أنّ ادخار مبلغ صغير بقيمة 5 دولارات شهريًا يمكن أن يزيد بمرور الوقت.

- الحد من استخدام بطاقة الائتمان. قد تكون بطاقات الائتمان ذات فائدةٍ في أوقات الطوارئ، إلا أنّه من السهل الإفراط في الإنفاق منها مع احتمالية أن ينتهي بك المطاف إلى دفع المزيد من الفوائد. عند إعدادك حساب توفير لأوقات الطوارئ بدلاً من ذلك، فقد يساهم ذلك في توفير المال لك بشكل عام.

- مقارنة المصاريف الشهرية. تحقق ممّا إذا كنت مؤهلاً للحصول على سعر تأمين أقل على سيارتك أو حاول تبديل خطة هاتفك إلى خطة أخرى ذات تكلفة أقل. يمكن وضع الأموال التي تدّخرها مباشرة في حساب التوفير الخاص بك!

Seguridad social

Casi todos los trabajadores estadounidenses pueden obtener los beneficios de la seguridad social en su jubilación mediante los aportes de los impuestos sobre la nómina. Si usted cumple con los requisitos, recibirá pagos mensuales de la seguridad social a partir de los 62 años. No todas las personas obtienen los beneficios de la seguridad social, como algunos proveedores padres; sin embargo, usted puede cumplir con los requisitos para recibir un beneficio conyugal si está casado.

Estos son tres consejos simples para ayudarle a comprender la seguridad social y planear su jubilación:

- Compruebe si cumple con los requisitos. Puede ver si está pagando a la seguridad social al revisar su recibo de pago. Si aparece dinero en “Social Security Employee Tax” (Impuesto del empleado para seguridad social), entonces usted debe tener seguridad social.* Obtenga más información sobre el beneficio por jubilación de la seguridad social.

- Utilice esta sencilla calculadora de seguridad social. Ingrese su fecha de nacimiento y sus ingresos para ver cuánto podría obtener de seguridad social y cuántos años tendrá en el momento que pueda empezar a recibir el pago mensual completo.

- Si está listo para jubilarse, cree una cuenta my Social Security para aplicar.

* Si no cumple con los requisitos para la seguridad social, considere abrir una IRA a través de Washington’s Retirement Marketplace (mercado de seguros de jubilación de Washington). ¡Es fácil y asequible!

Cuentas individuales de jubilación (IRA) a través del Washington’s Retirement Marketplace (mercado de seguros de jubilación de Washington)

Abrir una cuenta individual de jubilación (IRA) es una opción fácil que le permite ahorrar más dinero para su jubilación, además de lo que recibe a través de su SEIU 775 Secure Retirement Plan (plan de jubilación asegurada de SEIU 775, SRP). Usted puede abrir una cuenta IRA con tan solo $5 a través de Washington’s Retirement Marketplace (mercado de seguros de jubilación de Washington), un aliado de confianza para la jubilación.

El dinero que aporte a su cuenta IRA ganará intereses y se acumulará con el tiempo.

¿Por qué abrir una cuenta IRA?

- ¡Solo tiene que invertir $5! Abrir una cuenta IRA es fácil y asequible.

- Su dinero aumentará con el tiempo. No importa que solo pueda aportar una pequeña cantidad de dinero a su cuenta IRA cada mes; con el tiempo, podrá aportar mucho dinero a su jubilación.

- Puede tener varias fuentes de ingresos para la jubilación. El SRP es solo una de las fuentes de ingresos que tiene cuando se jubila. Ahorrar su propio dinero a través de una cuenta IRA puede ayudarle a jubilarse con más tranquilidad.

Ahorro personal y ahorro para casos de emergencia

Abrir y hacer aportes a una cuenta de ahorro personal es otra parte importante de la jubilación. Ahorrar tan solo $5 al mes puede suponer una gran diferencia al momento de jubilarse.

Puede ser difícil planear las emergencias y los gastos inesperados, como las facturas del veterinario o los problemas con el auto, y ni hablar de la jubilación. Pero, si toma algunas medidas para planear, puede evitar que esos gastos se conviertan en una carga pesada.

Estos son 4 consejos que le ayudarán a empezar sus ahorros personales y a ahorrar para casos de emergencia:

- Crear un presupuesto. Empiece por hacer una comparación entre la cantidad de dinero que gana cada mes y la cantidad que gasta en un mes normal. De este modo, podrá decidir en qué puede gastar menos, y cuánto dinero puede depositar en una cuenta de ahorro.

- Establecer el ahorro automático en su banco. Puede decidir cuánto y con qué frecuencia ahorrar. Incluso un ahorro de tan solo $5 al mes puede sumar con el tiempo.

- Limitar el uso de la tarjeta de crédito. Las tarjetas de crédito pueden ser útiles en caso de emergencia, sin embargo, puede ser fácil gastar más de lo necesario y terminar pagando más en intereses. En cambio, tener una cuenta de ahorro para casos de emergencia puede ayudarle a ahorrar dinero de manera general.

- Comparar los gastos mensuales. Compruebe si cumple con los requisitos para obtener una tarifa de seguro de auto más baja o intente cambiar a un plan de teléfono más económico. ¡El dinero que ahorre podrá depositarlo directamente en su cuenta de ahorro!

របបសន្តិសុខសង្គម

ស្ទើរតែគ្រប់កម្មករជនជាតិអាមេរិកទាំងអស់អាចទទួលបានអត្ថប្រយោជន៍របបសន្តិសុខសង្គមនៅក្នុងការចូលនិវត្តន៍របស់ពួកគេដោយធ្វើការរួមចំណែកពន្ធលើប្រាក់បៀវត្សរ៍។ ប្រសិនបើអ្នកមានលក្ខណៈសម្បត្តិគ្រប់គ្រាន់ នោះអ្នកទទួលបានការទូទាត់ប្រាក់របបសន្តិសុខសង្គមប្រចាំខែចាប់ពីអាយុ 62 ឆ្នាំ។ មិនមែនគ្រប់គ្នាសុទ្ធតែទទួលបានរបបសន្តិសុខសង្គម ដូចអ្នកផ្តល់សេវាដល់មាតាបិតាមួយចំនួននោះទេ ប៉ុន្តែអ្នកនៅតែអាចមានលក្ខណៈសម្បត្តិគ្រប់គ្រាន់ដើម្បីទទួលបានអត្ថប្រយោជន៍ប្តីប្រពន្ធ ប្រសិនបើអ្នករៀបការហើយ។

ខាងក្រោមនេះគឺជាគន្លឹះសាមញ្ញចំនួន 3 ដើម្បីជួយអ្នកឱ្យយល់ពីរបបសន្តិសុខសង្គម និងរៀបចំផែនការសម្រាប់ការចូលនិវត្តរបស់អ្នក៖

- មើលថាតើអ្នកមានលក្ខណៈគ្រប់គ្រាន់ដែរឬទេ។ អ្នកអាចមើលថាតើអ្នកកំពុងបង់ចូលរបបសន្តិសុខសង្គមដោយមើលលើបណ្ណបើកប្រាក់បៀវត្សរ៍របស់អ្នក។ ប្រសិនបើមានការបញ្ចូលលុយនៅក្រោម “Social Security Employee Tax (ពន្ធនិយោជិតសម្រាប់របបសន្តិសុខសង្គម)” នោះអ្នកគួរតែមានរបបសន្តិសុខសង្គម។* ស្វែងយល់បន្ថែមអំពីអត្ថប្រយោជន៍នៃការចូលនិវត្តរបស់សន្តិសុខសង្គម។

- ប្រើម៉ាស៊ីនគិតលេខរបបសន្តិសុខសង្គមដែលងាយស្រួលប្រើនេះ។ បញ្ចូលថ្ងៃខែឆ្នាំកំណើត និងប្រាក់ចំណូលរបស់អ្នក ដើម្បីមើលថាតើអ្នកអាចទទួលបានអត្ថប្រយោជន៍ប៉ុន្មានពីរបបសន្តិសុខសង្គម និងអាយុប៉ុន្មានដែលអ្នកនឹងអាចចាប់ផ្តើមទទួលបានប្រាក់ទូទាត់ប្រចាំខែពេញរបស់អ្នក។

- ប្រសិនបើអ្នករួចរាល់ក្នុងការចូលនិវត្ត សូមបង្កើតគណនីរបបសន្តិសុខសង្គមរបស់ខ្ញុំដើម្បីដាក់ពាក្យសុំ។

*ប្រសិនបើអ្នកមិនមានលក្ខណៈសម្បត្តិគ្រប់គ្រាន់សម្រាប់របបសន្តិសុខសង្គមទេ សូមពិចារណាបើកគណនី IRA តាមរយៈទីផ្សារចូលនិវត្តន៍របស់រដ្ឋ Washington (Washington’s Retirement Marketplace)។ វាមានភាពងាយស្រួល និងតម្លៃធូរថ្លៃ!

គណនីចូលនិវត្តន៍បុគ្គល (IRA) តាមរយៈទីផ្សារចូលនិវត្តន៍របស់រដ្ឋ Washington (Washington’s Retirement Marketplace)

ការបើកគណនីចូលនិវត្តន៍បុគ្គល (Individual Retirement Account, IRA) គឺជាវិធីងាយស្រួលក្នុងការសន្សំលុយសម្រាប់ការចូលនិវត្តរបស់អ្នក – បន្ថែមពីលើអ្វីដែលអ្នកទទួលបានតាមរយៈគម្រោងចូលនិវត្តន៍ប្រកបដោយសុវត្ថិភាព SEIU 775 (Secure Retirement Plan, SRP) របស់អ្នក។ អ្នកអាចបើកគណនី IRA ដោយខ្លួនឯងត្រឹមតែទឹកប្រាក់ $5 តាមរយៈទីផ្សារចូលនិវត្តន៍របស់រដ្ឋ Washington (Washington’s Retirement Marketplace) ដែលជាដៃគូផ្នែកចូលនិវត្តន៍ដែលទទួលបានការជឿទុកចិត្ត។

លុយដែលអ្នកដាក់បន្ថែមទៅក្នុងគណនី IRA របស់អ្នកនឹងទទួលបានការប្រាក់ និងបូកបន្ថែមបន្តិចម្ដងៗ។

ហេតុអ្វីត្រូវបើកគណនី IRA?

- ត្រឹមតែ $5 ប៉ុណ្ណោះ! ងាយស្រួលនិងតម្លៃទាបក្នុងការបើកគណនី IRA។

- ទឹកប្រាក់របស់អ្នកនឹងកើនឡើងបន្តិចម្ដងៗ។ ទោះបីជាអ្នកអាចដាក់ត្រឹមតែទឹកប្រាក់ចំនួនតិចតួចក៏ដោយនៅក្នុងគណនី IRA របស់អ្នកជារៀងរាល់ខែ រយៈពេលកាន់តែយូរនោះទឹកប្រាក់របស់អ្នកនឹងកាន់តែកើនឡើងនៅពេលអ្នកចូលនិវត្ត។

- មានប្រភពប្រាក់ចំណូលចូលនិវត្តន៍ជាច្រើន។ SRP គឺជាប្រភពតែមួយប៉ុណ្ណោះនៃប្រាក់ចំណូលដែលអ្នកមាននៅពេលអ្នកចូលនិវត្តន៍។ ការសន្សំប្រាក់ផ្ទាល់ខ្លួនរបស់អ្នកតាមរយៈ IRA អាចជួយអ្នកឱ្យចូលនិវត្តន៍កាន់តែមានសុវត្ថិភាព។

ការសន្សំផ្ទាល់ខ្លួន និងការសន្សំសម្រាប់ស្ថានភាពបន្ទាន់

ការបើក និងរួមចំណែកដល់គណនីសន្សំផ្ទាល់ខ្លួន គឺជាផ្នែកសំខាន់មួយទៀតនៃការចូលនិវត្ត។ ការសន្សំប្រាក់ត្រឹមតែ 5 ដុល្លារក្នុងមួយខែ នោះអាចធ្វើឱ្យមានការផ្លាស់ប្តូរដ៏ធំមួយនៅពេលដែលអ្នកត្រៀមខ្លួនចូលនិវត្តន៍។

អាចជារឿងពិបាកក្នុងការរៀបចំផែនការសម្រាប់ស្ថានភាពបន្ទាន់ ព្រមទាំងការចំណាយដែលមិនបានរំពឹងទុកដូចជាបង់ថ្លៃវិក្កយបត្រពេទ្យសត្វ ឬបញ្ហារថយន្តជាដើម។ ប៉ុន្តែ ប្រសិនបើអ្នកអនុវត្តតាមជំហានខ្លះៗដើម្បីរៀបចំផែនការ អ្នកអាចបញ្ចៀសមិនឱ្យការចំណាយទាំងនោះក្លាយជាបន្ទុកដ៏ធំបាន។

ខាងក្រោមនេះជាគន្លឹះទាំង 4 ដើម្បីជួយអ្នកចាប់ផ្តើមការសន្សំផ្ទាល់ខ្លួនរបស់អ្នក និងសន្សំសម្រាប់ស្ថានភាពបន្ទាន់ផ្សេងៗ៖

- បង្កើតកញ្ចប់ថវិកា។ ចាប់ផ្តើមដោយប្រៀបធៀបចំនួនលុយដែលអ្នករកបានរៀងរាល់ខែជាមួយនឹងចំនួនដែលអ្នកចំណាយជាទូទៅក្នុងមួយខែ។ បន្ទាប់មកអ្នកអាចសម្រេចចិត្តថាអ្នកអាចកាត់បន្ថយការចំណាយលើអ្វីខ្លះ ព្រមទាំងចំនួនលុយដែលអ្នកអាចដាក់ទៅក្នុងគណនីសន្សំបាន។

- បង្កើតការសន្សំប្រាក់ស្វ័យប្រវត្តិជាមួយធនាគាររបស់អ្នក។ អ្នកអាចសម្រេចថាចំនួនប៉ុន្មាន និងញឹកញាប់ប៉ុណ្ណាដែលអ្នកត្រូវដាក់សន្សំ។ សូម្បីតែសន្សំបន្តិចត្រឹមតែ $5 រៀងរាល់ខែក៏អាចបង្កើនចំនួនបន្តិចម្ដងៗផងដែរ។

- ដាក់កម្រិតលើការប្រើកាតក្រេឌីត។ កាតក្រេឌីតអាចមានប្រយោជន៍សម្រាប់ស្ថានភាពបន្ទាន់ ប៉ុន្តែវាអាចនឹងងាយធ្វើឱ្យមានការចំណាយជ្រុល ហើយជាលទ្ធផលអ្នកអាចនឹងត្រូវបង់ការប្រាក់បន្ថែមទៀតផង។ ផ្ទុយទៅវិញនៅពេលអ្នកមានគណនីសន្សំប្រាក់សម្រាប់ស្ថានភាពបន្ទាន់ វាអាចជួយអ្នកសន្សំលុយជារួម។

- ប្រៀបធៀបការចំណាយប្រចាំខែ។ ពិនិត្យមើលថាតើអ្នកមានលក្ខណៈសម្បត្តិគ្រប់គ្រាន់ដើម្បីទទួលបានអត្រាធានារ៉ាប់រងរថយន្តកាន់តែទាប ឬព្យាយាមប្តូរទៅគម្រោងទូរសព្ទដែលមិនសូវថ្លៃ។ លុយដែលអ្នកសន្សំអាចដាក់ដោយផ្ទាល់ទៅក្នុងគណនីសន្សំប្រាក់របស់អ្នក!

사회 보장

급여세를 납부한 거의 모든 미국 근로자는 퇴직 후 사회 보장 혜택을 받을 수 있습니다. 자격이 되는 경우에 62세부터 매월 사회 보장 수당을 받게 됩니다. 일부 부모 서비스 제공자처럼 모든 사람이 사회 보장 혜택을 받는 것은 아니지만, 결혼한 경우 배우자 혜택을 받을 자격이 될 수 있습니다.

다음은 사회 보장 제도에 대해 이해하고 퇴직 계획을 세우는 데 도움이 되는 3가지 간단한 팁입니다.

- 자격이 되는지 확인해 보십시오. 급여 명세서를 보면 사회 보장에 납부하고 있는지 여부를 확인할 수 있습니다. “Social Security Employee Tax(사회 보장 근로자 세금)” 항목에 금액이 명시된 경우 사회 보장에 가입되어 있는 것입니다.* 사회 보장 퇴직 혜택에 대한 자세한 내용을 알아보십시오.

- 간편한 사회 보장 계산기를 사용하세요. 생년월일과 소득을 입력하면 사회 보장에서 얼마를 받을 수 있는지 그리고 몇 살부터 월 지급액 전액을 받을 수 있는지 확인할 수 있습니다.

- 퇴직할 준비가 되셨다면 my Social Security(내 사회 보장 계정)을 만들어서 신청하세요.

*사회 보장 자격이 없다면 Washington’s Retirement Marketplace을 통해 IRA를 개설하는 것을 고려하십시오. 쉽고 저렴합니다!

Washington’s Retirement Marketplace를 통한 Individual Retirement Account(개인 퇴직금 적립 계정, IRA)

Individual Retirement Account(개인 퇴직금 적립 계정, IRA)를 개설하면 SEIU 775 Secure Retirement Plan(보장성 퇴직 신탁, SRP) 이외에도 퇴직에 대비하여 자금을 추가로 간편하게 저축할 수 있습니다. $5만 있으면 믿을 수 있는 퇴직 파트너인 Washington’s Retirement Marketplace를 통해 IRA를 직접 개설할 수 있습니다.

IRA에 적립한 자금에는 이자가 지급되어 시간이 지남에 따라 금액이 불어납니다.

IRA를 개설하는 이유는 무엇입니까?

- 단 $5입니다! 쉽고 저렴하게 IRA를 개설할 수 있습니다.

- 자금은 시간이 지남에 따라 불어납니다. IRA에 매월 적은 금액을 적립해도 시간이 지남에 따라 퇴직 시 받을 수 있는 금액이 불어납니다.

- 많은 퇴직 소득원을 갖게 됩니다. SRP는 퇴직할 때 받을 수 있는 수입원 중 하나에 불과합니다. IRA를 통해 저축하면 보다 편안한 마음으로 퇴직할 수 있습니다.

신뢰할 수 있는 리소스인 Washington’s Retirement Marketplace를 통해 IRA를 개설하는 방법에 대해 자세히 알아보십시오.

개인 저축 및 응급 상황을 위한 저축

개인 저축 계좌를 개설하고 적립하는 것은 퇴직을 준비하기 위한 또 다른 중요한 부분입니다. 매달 $5만 저축하면 은퇴할 준비가 되었을 때 큰 차이를 만들 수 있습니다.

응급 상황 및 동물 진료비나 자동차 문제와 같은 예상치 못한 비용에 대한 계획을 세우기가 어려울 수 있습니다. 그러나, 몇 가지 방법을 통해 계획을 세운다면 그러한 비용이 큰 부담으로 다가오는 것을 피할 수 있습니다.

다음은 응급 상황에 대비하여 개인 저축을 시작할 수 있는 4가지 팁입니다.

- 예산을 세우십시오. 일반적으로 한 달에 버는 돈과 한 달에 쓰는 돈을 비교하는 것부터 시작하십시오. 그 다음에 지출을 줄일 수 있는 항목과 저축 계좌에 적립한 자금을 결정할 수 있습니다.

- 은행에 자동 이체 저축을 설정하십시오. 저금할 금액과 빈도를 결정할 수 있습니다. 매달 5달러만 절약해도 시간이 지남에 따라 금액이 커질 수 있습니다.

- 신용 카드 사용을 제한하십시오. 신용 카드는 응급 상황에서 도움이 될 수 있지만 과소비하기 쉽고 결국 더 많은 이자를 지불하게 될 수 있습니다. 대신에 응급 상황에 대비한 저축 계좌를 설정하면 전반적으로 돈을 절약하는 데 도움이 될 수 있습니다.

- 월 지출액을 비교하십시오. 자동차 보험료를 낮출 자격이 되는지 확인하거나 더 저렴한 전화 요금제로 전환해 보십시오. 절약한 돈은 저축 계좌로 바로 입금할 수 있습니다!

Социальное страхование

Почти все работники в Америке могут получать пособия по социальному страхованию после выхода на пенсию, если они выплачивали налоги с заработной платы. Если вы соответствуете требованиям, вы можете получать ежемесячные выплаты по социальному страхованию, начиная с 62 лет. Не все получают пособия по социальному страхованию (например, некоторые родители — поставщики услуг), но вы можете претендовать на пособие для супругов, если состоите в браке.

Эти три простых совета помогут вам больше узнать о социальном страховании и спланировать выход на пенсию:

- Узнайте, соответствуете ли вы требованиям. Узнать о том, отчисляете ли вы взносы в Фонд социального страхования, можно из своей зарплатной ведомости. Если в ней указана сумма денег в графе Social Security Employee Tax (Взнос в Фонд социального страхования сотрудников), значит, вы можете получать пособия по социальному страхованию.* Узнайте больше о пособии по пенсионному и социальному страхованию.

- Предлагаем простой и удобный калькулятор социального страхования. Укажите свой доход и дату рождения, чтобы увидеть, сколько вы можете получать из Фонда социального страхования и сколько вам будет лет, когда вы начнете получать свой полный ежемесячный платеж.

- Если вы готовы к выходу на пенсию, создайте счет my Social Security.

* Если у вас нет права на пособие по социальному страхованию, подумайте об открытии счета IRA на Washington Retirement Marketplace (Бирже планов социального обеспечения штата Вашингтон). Это легко и доступно!

IRA (Индивидуальный пенсионный счет) на Washington Retirement Marketplace (Бирже планов социального обеспечения штата Вашингтон)

IRA (Индивидуальный пенсионный счет) — это доступный способ увеличить пенсионные сбережения в дополнение к преимуществам вашего SEIU 775 Secure Retirement Plan (Плана надежного пенсионного обеспечения, SRP). Вы можете открыть счет IRA самостоятельно всего за $5 у надежного партнера — на Washington Retirement Marketplace (Бирже планов пенсионного обеспечения штата Вашингтон).

Со временем накопления на счету IRA будут увеличиваться за счет процентов.

Зачем нужно открывать счет IRA?

- Это стоит всего $5! Открыть счет IRA просто и доступно.

- Со временем ваши сбережения увеличиваются. Даже если ежемесячно откладывать на счет IRA лишь небольшую сумму денег, со временем это станет значительной прибавкой к вашей пенсии.

- У вас будет несколько источников пенсионного дохода. План SRP — ваш единственный источник дохода после выхода на пенсию. Личные сбережения на счету IRA повысят комфорт вашей жизни на пенсии.

Личные сбережения и средства на случай чрезвычайных ситуаций

Открытие и пополнение личного сберегательного счета также важны для пенсионных накоплений. Откладывая хотя бы по $5 в месяц, вы сможете накопить большую сумму при выходе на пенсию.

Планировать бюджет с учетом непредвиденных расходов, например на ветеринарные услуги или автосервис, бывает непросто. А что уж говорить о пенсии… Но если вы все распланируете, то сможете избежать этого тяжкого бремени.

Предлагаем 4 совета по накоплению личных сбережений и экономии средств на случай чрезвычайных ситуаций:

- Составьте бюджет. Начните со сравнения ежемесячных доходов и расходов. Затем определите, на что можно тратить меньше денег и сколько отложить на сберегательный счет.

- Подключите автоматические накопления в своем банке. Вы можете решить, сколько денег и как часто откладывать. Даже откладывая всего $5 каждый месяц, вы со временем сможете накопить большую сумму.

- Ограничьте использование кредитной карты. Кредитные карты могут помочь в экстренных ситуациях, но можно потратить слишком много денег, и тогда придется платить большие проценты. Однако если вы откроете сберегательный счет на случай непредвиденных обстоятельств, то сможете сэкономить деньги.

- Сравните ежемесячные расходы. Проверьте, есть ли у вас право на пониженную ставку автострахования, или перейдите на более выгодный тарифный план телефонной связи. А сэкономленные деньги напрямую переведите на сберегательный счет!

Соціальне страхування

Майже кожен американський працівник може отримати виплати соціального страхування після виходу на пенсію, якщо сплачує податок із заробітної плати. Якщо ви відповідаєте вимогам, то, починаючи з 62 років, отримуватимете щомісячні виплати соціального страхування. Не всі отримують таке соціальне страхування, як деякі батьки-годувальники, але ви однаково можете претендувати на допомогу, як чоловік/дружина, якщо одружені.

Ось 3 поради, завдяки яким ви зрозумієте, що таке соціальне страхування, і зможете спланувати свій вихід на пенсію:

- Дізнайтеся, чи відповідаєте ви вимогам. Ви можете дізнатися, чи сплачуєте кошти у фонд соціального страхування, ознайомившись зі своєю розрахунково-платіжною відомістю. Якщо в розділі Social Security Employee Tax (Податок працівника у фонд соціального страхування) зазначено кошти, ви маєте право на соціальне страхування.* Дізнайтеся більше про пенсійні виплати соціального страхування.

- Скористайтеся цим простим калькулятором соціального страхування. Укажіть свої дату народження та дохід, щоб дізнатися суму соціального страхування і вік, коли ви матимете змогу отримувати повноцінну щомісячну виплату.

- Якщо ви вже готові вийти на пенсію, створіть рахунок my Social Security (Моє соціальне страхування), щоб подати заявку.

* Якщо ви не відповідаєте вимогам для виплат через фонд соціального страхування, відкрийте IRA за допомогою Washington’s Retirement Marketplace. Зробити це дуже просто й доступно!

Індивідуальні пенсійні рахунки (IRA) через Washington’s Retirement Marketplace

Відкриття індивідуального пенсійного рахунку (IRA) — це простий спосіб накопичити більше грошей на пенсію на додаток до того, що ви отримуєте за допомогою SEIU 775 Secure Retirement Plan (План надійного пенсійного забезпечення, SRP). Ви можете відкрити IRA самостійно всього за 5 доларів США через Washington’s Retirement Marketplace, надійного партнера з питань пенсійного забезпечення.

Гроші, які ви додаєте до свого IRA, приноситимуть відсотки та з часом сума збільшуватиметься.

Навіщо відкривати IRA?

- Це всього 5 доларів США! Відкрити IRA просто й доступно.

- Кількість грошей із часом примножиться. Навіть якщо ви можете класти лише невелику суму грошей на свій IRA щомісяця, з часом це може істотно збільшити суму грошей, яка додасться до вашої пенсії.

- Майте багато джерел пенсійного доходу. SRP — це лише одне з джерел доходу, який ви маєте після виходу на пенсію. Накопичувати гроші через IRA може стати в нагоді, щоб комфортно вийти на пенсію.

Дізнайтеся більше про відкриття IRA через Washington’s Retirement Marketplace, довірений ресурс.

Особисті заощадження та накопичення на випадок надзвичайної ситуації

Відкриття та внесення коштів на рахунок для особистих накопичень є ще однією важливою частиною виходу на пенсію. Заощаджування всього лише 5 доларів США щомісяця може мати велике значення, коли настане час і ви будете готові вийти на пенсію.

Може бути важко скласти план на випадок надзвичайної ситуації та несподіваних витрат, як-от ветеринарні рахунки чи проблеми з автомобілем, не кажучи вже про вихід на пенсію. Однак, якщо ви зробите певні кроки для планування, то зможете уникнути того, щоб ці витрати стали важким тягарем.

Ось 4 поради, які допоможуть вам почати створювати особисті заощадження та накопичувати на випадок надзвичайної ситуації:

- Створіть бюджет. Почніть із порівняння того, скільки грошей ви заробляєте щомісяця, з тим, скільки витрачаєте за звичайний місяць. Тоді ви зможете вирішити, на що можна витрачати менше та скільки грошей покласти на рахунок для особистих накопичень.

- Налаштуйте автоматичні накопичення у своєму банку. Ви можете вирішити, скільки і як часто накопичувати. Навіть заощаджуючи лише 5 доларів щомісяця, з часом можна накопичити більше.

- Обмежте використання кредитної картки. Кредитні картки можуть бути корисними в надзвичайних ситуаціях, але можна легко витратити надто багато, а внаслідок цього ви можете сплатити більше відсотків. Натомість якщо у вас є рахунок для особистих заощаджень, створений для надзвичайних ситуацій, це може допомогти вам накопичити гроші загалом.

- Порівняйте місячні витрати. Перевірте, чи маєте ви право на нижчу ставку для страхування автомобіля, або спробуйте перейти на менш дорогий тарифний план телефонного зв’язку. Гроші, які ви заощадите, можна покласти прямо на ваш рахунок для особистих накопичень!

An Sinh Xã Hội

Hầu hết mọi người lao động Mỹ đều có thể nhận trợ cấp An Sinh Xã Hội khi về hưu bằng cách đóng góp thuế lương. Nếu đủ điều kiện, bạn sẽ nhận được khoản thanh toán An Sinh Xã Hội hằng tháng bắt đầu sớm nhất là 62 tuổi. Không phải ai cũng được nhận trợ cấp An Sinh Xã Hội, chẳng hạn như một số Nhà Cung Cấp Chính, nhưng bạn vẫn có thể đủ điều kiện nhận phúc lợi dành cho vợ/chồng nếu bạn đã kết hôn.

Sau đây là 3 mẹo đơn giản để giúp bạn hiểu về An Sinh Xã Hội và lập kế hoạch về hưu:

- Xem bạn có đủ điều kiện hay không. Bạn có thể biết liệu mình có đang thanh toán cho chương trình An Sinh Xã Hội hay không bằng cách xem cuống phiếu lương của mình. Nếu có số tiền được nhập dưới mục “Social Security Employee Tax” (Thuế Của Nhân Viên Hưởng An Sinh Xã Hội), thì tức là bạn được hưởng An Sinh Xã Hội.* Tìm hiểu thêm về phúc lợi Hưu Trí An Sinh Xã Hội.

- Hãy dùng công cụ tính mức An Sinh Xã Hội dễ sử dụng này. Nhập ngày sinh và thu nhập của bạn để xem số tiền bạn có thể nhận được từ chương trình An Sinh Xã Hội và số tuổi khi bạn bắt đầu nhận được toàn bộ khoản thanh toán hằng tháng.

- Nếu bạn đã sẵn sàng về hưu, hãy tạo tài khoản An Sinh Xã Hội của tôi để đăng ký.

* Nếu bạn không đủ điều kiện hưởng An Sinh Xã Hội, hãy cân nhắc mở một IRA thông qua Washington’ s Retirement Marketplace. Rất dễ dàng và không tốn kém!

Tài Khoản Hưu Trí Cá Nhân (IRA) thông qua Washington’s Retirement Marketplace

Mở Tài Khoản Hưu Trí Cá Nhân (IRA) là cách đơn giản để tiết kiệm thêm tiền cho khoản hưu trí của bạn – ngoài những gì bạn nhận được thông qua SEIU 775 Secure Retirement Plan (Chương Trình Hưu Trí An Toàn SEIU 775 – SRP). Bạn có thể tự mở tài khoản IRA chỉ với $5 thông qua Washington’s Retirement Marketplace. Đây là một đối tác hưu trí đáng tin cậy.

Tiền bạn nạp vào tài khoản IRA sẽ được tính lãi và tăng thêm theo thời gian.

Tại sao nên mở tài khoản IRA?

- Bạn chỉ cần có $5 để mở tài khoản! Bạn có thể mở tài khoản IRA dễ dàng mà cũng không tốn kém.

- Số tiền của bạn sẽ tăng theo thời gian. Ngay cả nếu bạn chỉ nạp một số tiền nhỏ vào tài khoản IRA mỗi tháng, theo thời gian, số tiền đó có thể đóng góp rất lớn vào khoản hưu trí của bạn.

- Có nhiều nguồn thu nhập khi về hưu. SRP là nguồn thu nhập duy nhất bạn có khi về hưu. Việc tự tiết kiệm tiền thông qua tài khoản IRA có thể giúp cuộc sống hưu trí của bạn thoải mái hơn.

Khoản Tiết Kiệm Cá Nhân và Khoản Tiết Kiệm cho Những Trường Hợp Khẩn Cấp

Mở và đóng góp vào tài khoản tiết kiệm cá nhân là một việc quan trọng khác cho lúc về hưu. Tiết kiệm ít nhất $5 mỗi tháng có thể tạo ra sự khác biệt lớn vào thời điểm bạn sẵn sàng về hưu.

Thật khó có thể lên kế hoạch cho các trường hợp khẩn cấp và các chi phí không mong muốn, chẳng hạn như hóa đơn thú y hoặc các vấn đề xảy ra với ô tô, chưa kể đến việc về hưu. Tuy nhiên, nếu thực hiện một số bước để lên kế hoạch, bạn có thể tránh được trường hợp những khoản phí đó trở thành gánh nặng cho bạn.

Dưới đây là 4 mẹo giúp bạn bắt đầu khoản tiết kiệm cá nhân và tiết kiệm cho các trường hợp khẩn cấp:

- Lập ngân sách. Bắt đầu bằng cách so sánh số tiền bạn kiếm được mỗi tháng so với số tiền bạn chi tiêu trong một tháng điển hình. Sau đó, bạn có thể quyết định mục có thể chi tiêu ít hơn và số tiền được chuyển vào tài khoản tiết kiệm.

- Thiết lập tiết kiệm tự động với ngân hàng. Bạn có thể quyết định số tiền và tần suất tiết kiệm. Ngay cả khi bạn tiết kiệm số tiền nhỏ $5 mỗi tháng thì số tiền cũng có thể tăng lên theo thời gian.

- Hạn chế sử dụng thẻ tín dụng. Thẻ tín dụng có thể hữu ích trong trường hợp khẩn cấp. Tuy nhiên, bạn có thể dễ chi tiêu quá nhiều và cuối cùng là có thể trả nhiều hơn cho tiền lãi. Khi đã thiết lập tài khoản tiết kiệm cho trường hợp khẩn cấp, nhìn chung là bạn có thể tiết kiệm được tiền.

- So sánh các khoản chi phí hằng tháng. Kiểm tra xem bạn có đủ điều kiện cho mức bảo hiểm ô tô thấp hơn hoặc thử chuyển sang một gói điện thoại ít tốn kém hơn. Khoản tiền mà bạn tiết kiệm được có thể được chuyển ngay vào tài khoản tiết kiệm của bạn!

社保

几乎每位美国工作者都可以通过缴纳工资税在退休后领取社保福利。如果您符合领取条件,最早可以从 62 岁开始每月领取社保金。不是每个人都能领取社保金,比如看护子女的父母看护人。但如果您是已婚人士,则可能还有资格领取配偶福利。

这里有 3 条简单的建议,可帮助您了解社保,并制定退休计划:

- 看看您是否符合资格。您可以通过查看自己的工资单,看看是否向社保缴费。如果在 “Social Security Employee Tax”(社保雇员税)下有金额,那么您应该有社保。*了解关于社保退休福利的更多信息。

- 使用这款简单易用的社保计算器。输入您的出生日期和您的收入,看看您能从社保中获得多少资金,以及您在多大年龄时可以开始每月全额领取社保金。

- 如果您准备退休,请创建 my Social Security 账号来申请。

*如果您没有资格享受社保,可以考虑通过 Washington’s Retirement Marketplace(华盛顿州退休计划市场)开设个人退休账户。这既简单又实惠!

通过 Washington’s Retirement Marketplace(华盛顿州退休计划市场)开设个人退休账户 (IRA)

在 SEIU 775 Secure Retirement Plan(安心悠享退休计划,SRP)的基础上,开设个人退休账户 (IRA) 是一种为退休储蓄更多钱的简单方法。通过值得信赖的退休计划合作伙伴 — Washington’s Retirement Marketplace(华盛顿州退休计划市场),您仅需 5 美元即可自行开设 IRA。

您存入 IRA 的钱会随着时间的推移产生利息。

为何要开设 IRA?

- 仅需 5 美元!开设 IRA 既简单又实惠。

- 您的钱会随着时间增长。即使您每个月只能往 IRA 里存一小笔钱,但随着时间的推移,您的退休金也会增加很多。

- 拥有多种退休收入来源。SRP 目前是您退休后唯一的收入来源。通过 IRA 自己存钱,可以帮助您在退休后生活更加舒适。

了解如何通过值得信赖的退休计划合作伙伴 — Washington’s Retirement Marketplace(华盛顿州退休计划市场)开设 IRA。

个人储蓄及为紧急情况储蓄

开设个人储蓄账户并缴款是另一种重要的退休储蓄方式。如果您已经准备退休,每个月只需存下 5 美元就能事半功倍。

为紧急情况和意外费用(如看兽医的账单或修车费用)制定计划可能很困难,更不必说是制定退休计划了。但是,如果您采取一些措施来计划,就不会让这些费用成为沉重的负担。

看看这 4 条建议,帮助您开始个人储蓄,并为应对紧急情况储蓄:

- 制订预算。首先做一个比较:您每个月赚多少钱?以及,您在一个常规的月份中花多少钱?然后您可以决定自己可以在哪些方面少花钱,以及将多少钱存入储蓄账户。

- 在您账户所在的银行设置自动储蓄。您可以决定储蓄的金额和频率。即使每月只存 5 美元,您的资金也会随着时间推移逐渐增长。

- 限制信用卡的使用在紧急情况下,信用卡可能很有用,但是,信用卡很容易超支,您最终可能不得不支付更多利息。而如果您设置了应对紧急情况的储蓄账户,这一账户可以帮助您在整个过程中节约资金。

- 比较每月的花费。看看您是否有资格获更低的汽车保险费率,或者尝试换到一个更便宜的电话计划。您节约的资金可以直接投入您的储蓄账户中!

What is the Saver’s Tax Credit and what does it do?

The Saver’s Tax Credit reduces your income tax bill by giving you credits for money you contribute to a retirement savings account. If you qualify, you could get up to $1,000 in tax refund credits.

What do I get from the Saver’s Tax Credit?

The credit is worth up to $1,000 or $2,000, depending on income and marital status.

How do I qualify for the tax credit?

You must make contributions to a retirement account like an individual retirement account (IRA), be over the age of 18, and meet income requirements.

Tax Credits for Families and Students

Child Tax Credit

The Child Tax Credit helps families with qualifying children get a tax break. You may be able to claim the credit even if you don’t normally file a tax return.

Child and Dependent Care Credit

The Child and Dependent Care Credit is a tax credit that may help you pay for the care of eligible children and other dependents.

American Opportunity Tax Credit

The American Opportunity Tax Credit (AOTC) is a credit for qualified education expenses paid for an eligible student for the first 4 years of higher education.

Lifetime Learning Credit

The Lifetime Learning Credit (LLC) is for qualified tuition and related expenses paid for eligible students enrolled in an eligible educational institution. This credit can help pay for undergraduate, graduate and professional degree courses.

Washington State Working Families Tax Credit

The Washington State Working Families Tax Credit is for individuals and families in Washington state who may be able to receive up to $1,200 back if eligible.

Milliman: the administrator for the SEIU 775 Secure Retirement Plan (SRP).

When you log in to Retirement: My Plan, you will be taken to Milliman’s website to see your SRP information. Your information is always confidential.

Washington’s Retirement Marketplace: compare state-verified, low-cost retirement savings plans.

Washington’s Retirement Marketplace is a secure website where businesses and individuals can comparison shop state-verified, low-cost retirement savings plans, such as Individual Retirement Accounts (IRA):

- Aspire: Aspire is one of the IRA providers found on the Washington Retirement Marketplace. They offer financial planning resources in addition to their Individual Retirement Accounts at affordable rates. Learn more or call Aspire directly at 1-206-939-5615.

- FinHabits: FinHabits is one of the IRA providers found on the Washington Retirement Marketplace. FinHabits provides diversified portfolios at affordable rates. Learn more or call FinHabits directly at 1-800-492-1175.

Resources through Washington’s Retirement Marketplace are available in 5 languages.

Consumer Financial Protection Bureau (CFPB): protects consumers from unfair, deceptive, or abusive practices.

Wherever you are in your retirement planning, you can use CFPB’s Consumer Tools to help you get prepared. Resources are available in 8 languages.

Social Security Resources for You

Budgeting Tools for You

- Learn more about the basics of budgeting on this helpful online resource called “Making a Budget,” from the Federal Trade Commission, whose mission is to protect consumers.

- It can be hard to make a budget yourself. You can also use this budget worksheet you can fill in to have a budget calculated for you.

Tax Credits for People with Disabilities

Tax Credit for the Elderly or the Disabled

The Credit for the Elderly or the Disabled helps retired taxpayers on permanent disability to get a tax credit based on qualifying income.

Medical Expense Deductions

The Medical Expense Deduction applies only to expenses not paid by insurance. Expenses may be covered if you made payments for the medical expense directly or if payment is made on your behalf to the doctor, hospital, or other medical provider.

Washington State ABLE Savings Plan

A Washington State ABLE Savings Plan is a flexible and convenient way for people living with disabilities to invest in their quality of life.

Federal Programs for Income and Retirement Savings

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund.

Saver’s Credit

The Saver’s Credit helps you take a tax credit for making eligible contributions to your IRA or employer-sponsored retirement plan.

Tax Preparation and Filing for Free

Tax preparation help

AARP Foundation Tax-Aide provides free tax assistance to anyone, with a focus on taxpayers over age 50 and have low to moderate income.

IRS Free File

IRS Free File lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software. It’s safe, easy and no cost to you.

IRS: Free tax preparation by volunteers

The IRS’s Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs offer free basic tax return preparation to qualified individuals.

Please contact a tax preparation professional if you need more assistance.

Questions?

Call a Secure Retirement Representative at 1-800-726-8303 (5 a.m. to 6 p.m. Pacific time, Monday-Friday) or visit Retirement: My Plan.